by Michael DiVita | Jul 28, 2015 | Mortgage Education

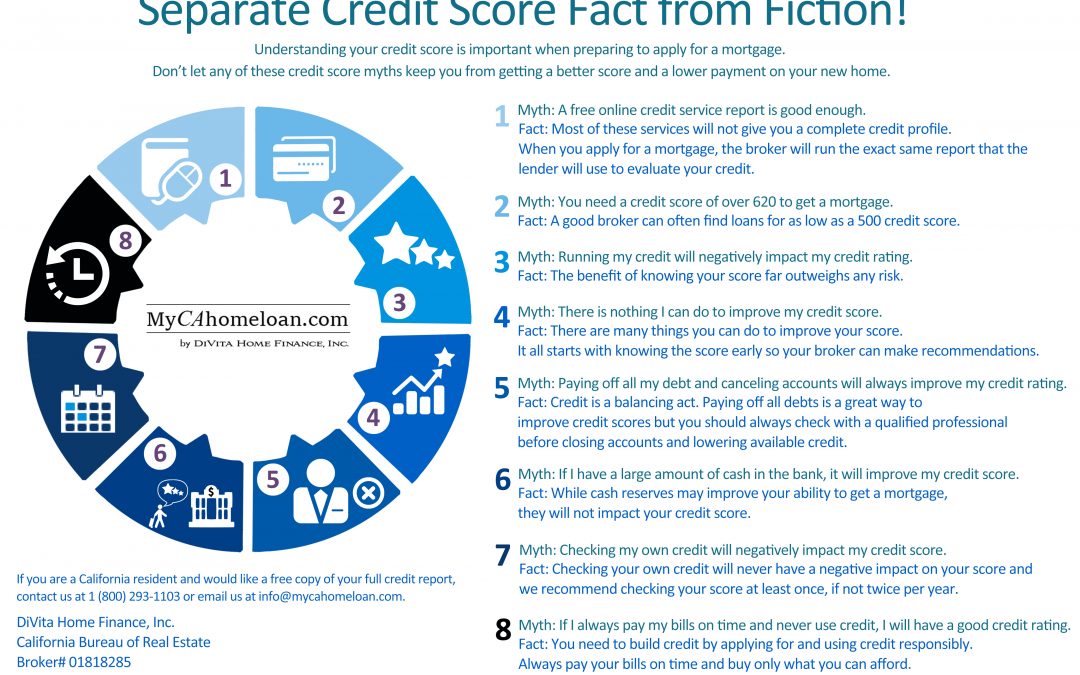

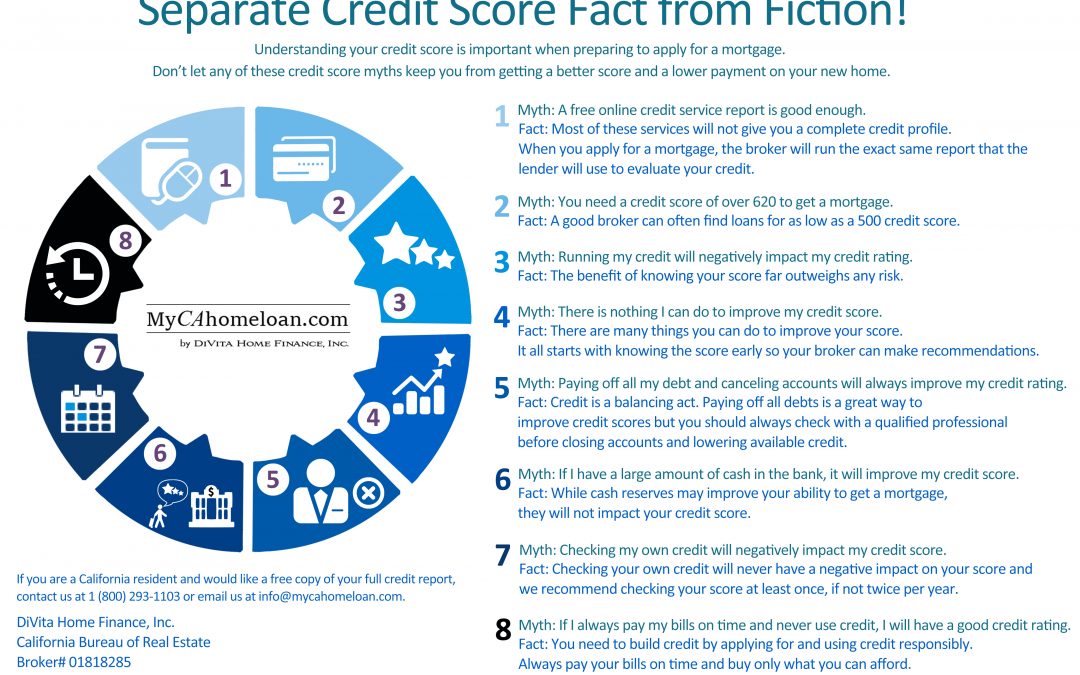

When buying Real Estate, you have to check your credit scores early! Although we have been told that running our credit too often is bad, when beginning any type of loan, information is power, and power is money. Being proactive can protect against inaccuracies. It...

by Michael DiVita | Jul 28, 2015 | Mortgage Education

Check out our Real Estate Loan Portal. A better client experience equals more referrals. In a day and age where technology for convenience is the norm, we at DiVita Home Finance feel that it is our obligation to offer both convenience and security that is second to...

by Michael DiVita | Mar 23, 2015 | Mortgage Education

Between 30% to 40% of all sales in the Bay Area are “all cash” offers. That’s a staggering statistic. How can the average buyer, who needs a loan, compete? The answer is, you need a great team consisting of: A seasoned real estate agent who knows the area, the other...

by Michael DiVita | Oct 10, 2014 | Mortgage Education, Uncategorized

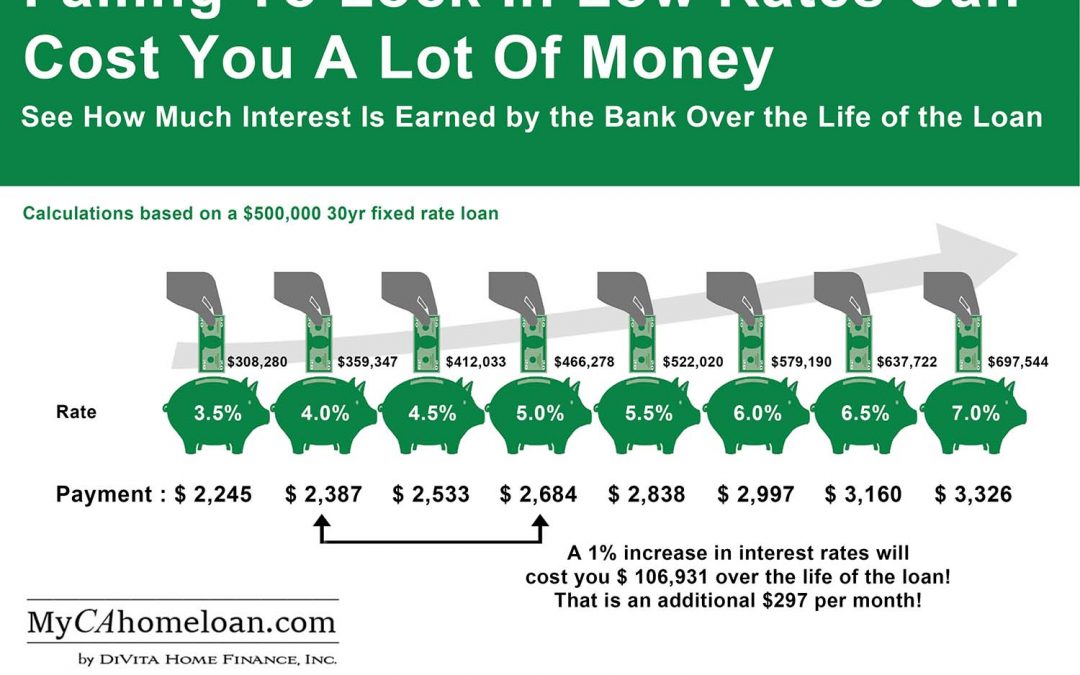

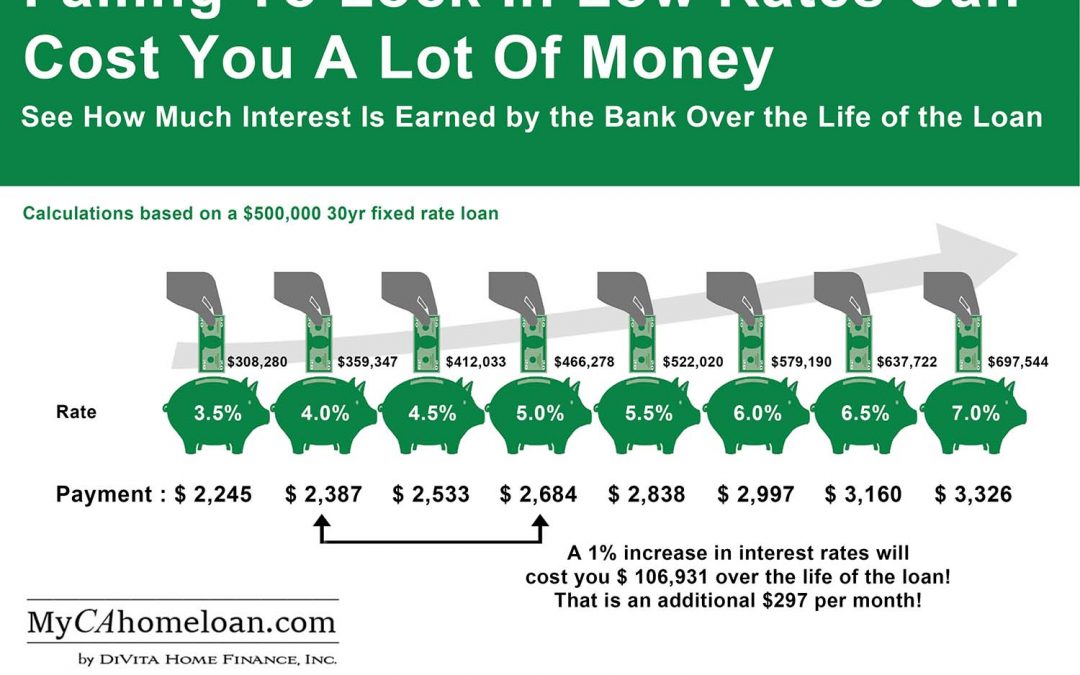

Download the pdf version of this infographic here: The Cost of Rising Interest Rates PDF

by Michael DiVita | Oct 10, 2014 | Mortgage Education

Homebuyers in many parts of the country are facing a tough choice. Face the fear of buying in a very hot market, or wait it out and face the fear of potential interest rate increases. It can be an extremely difficult decision for the average homebuyer. ...

by Michael DiVita | Aug 5, 2014 | How Banks Qualify Borrowers, Mortgage 101, Mortgage Education, Pre-Approval Process, Refinance 101

Click here for a downloadable pdf.