by Michael DiVita | Aug 5, 2014 | How Banks Qualify Borrowers, Mortgage 101, Mortgage Education, Pre-Approval Process, Refinance 101

Click here for a downloadable pdf.

by Michael DiVita | Jul 29, 2014 | How Banks Qualify Borrowers, Minute Mortgage Series, Mortgage 101, Mortgage Education, Video Series

Synonymous, in a way. They both secure home loans. A mortgage banker works for a specific bank. He offers the products from that bank’s portfolio only. A mortgage broker is independent and affiliated with many lending institutions including large national,...

by Michael DiVita | Jul 29, 2014 | How Banks Qualify Borrowers, Mortgage Education, Video Series

If you are self-employed it is important that you watch this video and get prepared early. It can be much more difficult to get approved as a self-employed borrower unless you understand what the bank is looking for. An experienced mortgage broker is a must in these...

by Michael DiVita | Jul 28, 2014 | How Banks Qualify Borrowers, Mortgage 101, Mortgage Education, Pre-Approval Process, Video Series

Pre-approval is a critical step when looking to buy a new home. Getting pre-approved early can make the entire process much more efficient by: Telling you exactly what you can afford to spend Allowing you to move fast when you find the home you want to buy...

by Michael DiVita | Jul 15, 2014 | How Banks Qualify Borrowers, Mortgage 101, Mortgage Education, Pre-Approval Process, Refinance 101, Video Series

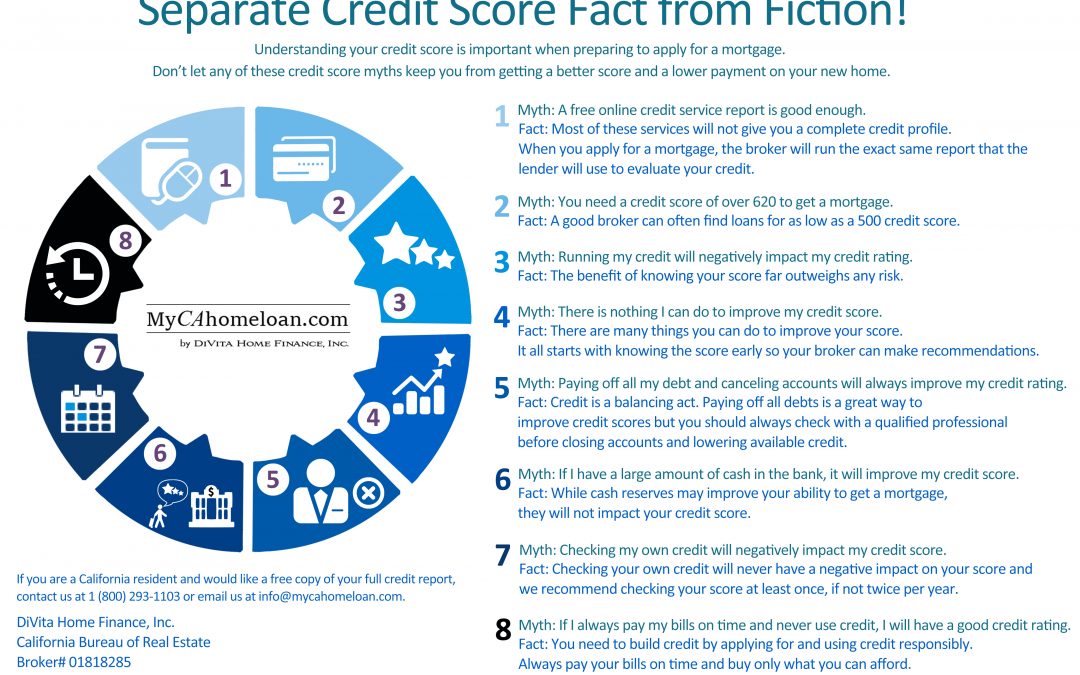

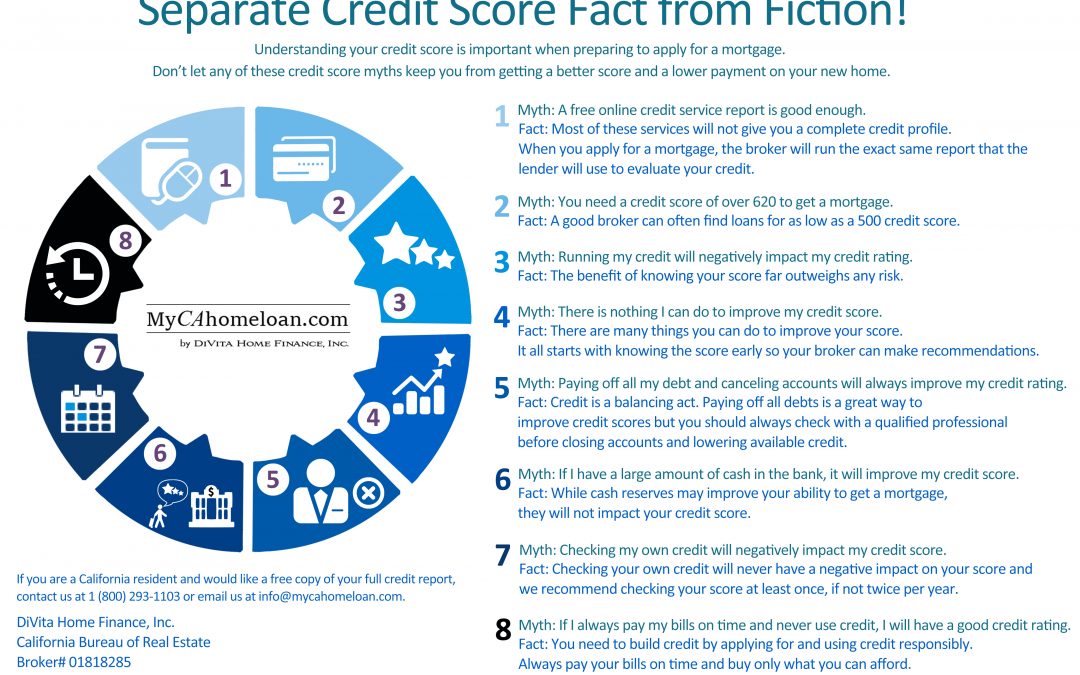

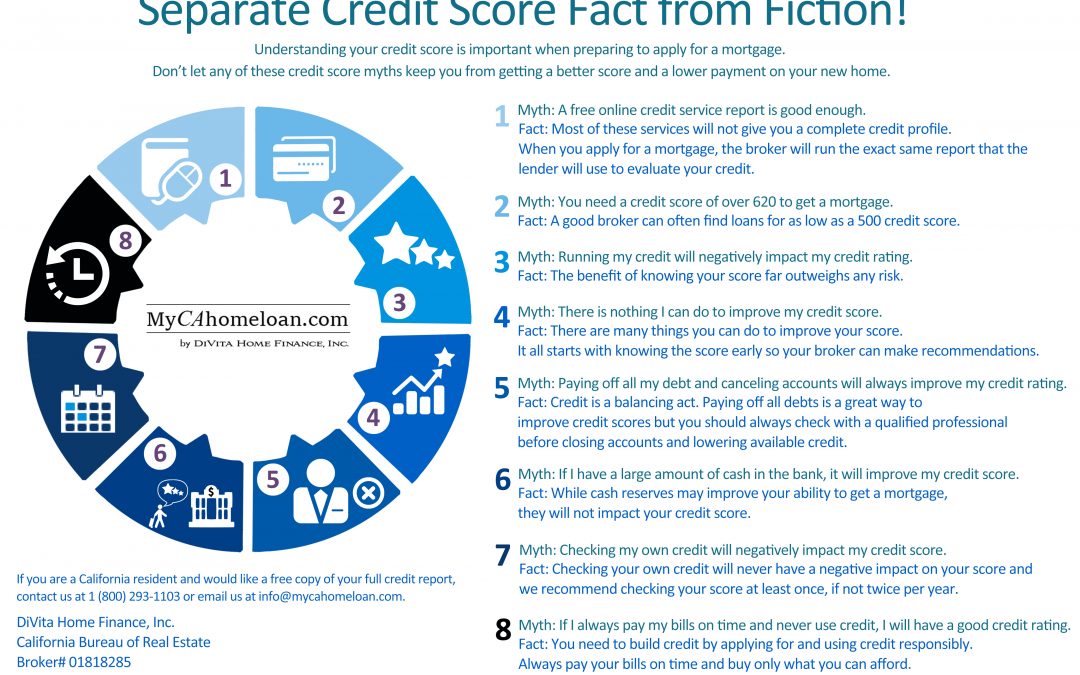

Don’t let any of these common credit score myths keep you from getting a better score and a lower payment on your new home. 8 Common Credit Score Myths 1. Myth: If I go to a free online credit reporting service, I will get a complete understanding of my credit rating....