Homebuyers in many parts of the country are facing a tough choice. Face the fear of buying in a very hot market, or wait it out and face the fear of potential interest rate increases. It can be an extremely difficult decision for the average homebuyer.

So how do you help clients work through this dilemma and make a good choice? No one really knows the right answer but here is a perspective;

Interest rates are at 45 year historical lows. By buying now, even in a hot market, your client could save enough in interest to make up significantly for the market pricing premium.

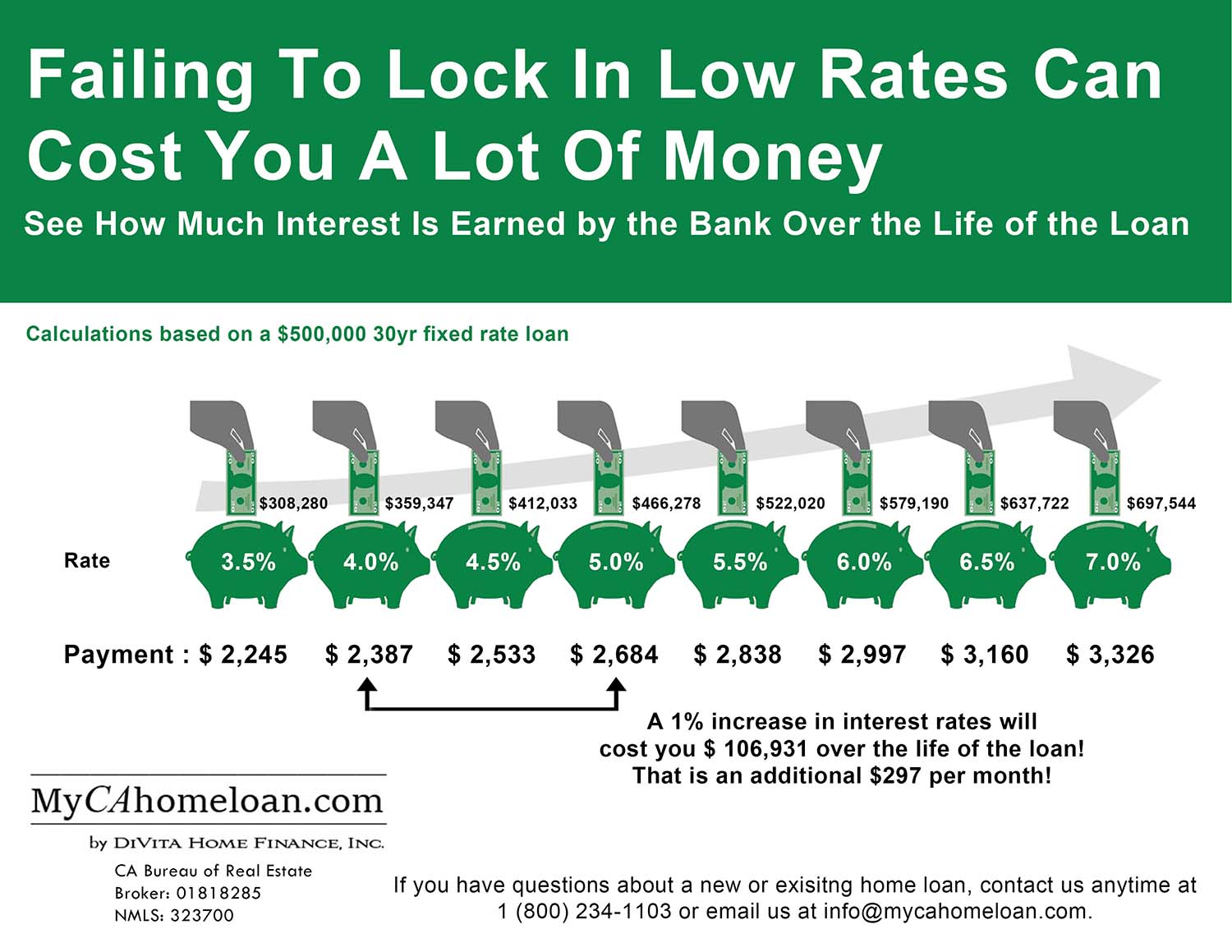

Below is the simple math you can use to show your client just how beneficial it can be to buy now, when rates are low.

(You can access an infographic that shows this math in detail by clicking on the image to the right.)

Let’s take the example of a $500,000 loan.

At today’s rates, many buyers will qualify for a 30 year fixed loan at 4%. In this scenario, the monthly payment would be $2,387 and the total interest cost over the term of the loan would be $359,346.

Remember when an excellent interest rate was 6%? It wasn’t that long ago. So let’s say that rates return to that same level over the next few years.

Now that same $500,000 loan looks a lot different. At 6%, the monthly payment would increase to $2,997 and the total cost of interest would be $579,192.

So…

| Loan Amout | Term | Int. Rate | Payment | Int. Owed |

| 500,000 | 30 | 4% | $2,387 | $359,346 |

| 500,000 | 30 | 6% | $2,997 | $579,192 |

That is a massive increase in total cost of $219,846. That my friends, covers a lot of the premium we are seeing in the market.

If your buyer is looking for a long term buy and hold, then they really need to weigh the cost of waiting out the hot market.

We might not see these levels again in our lifetime.